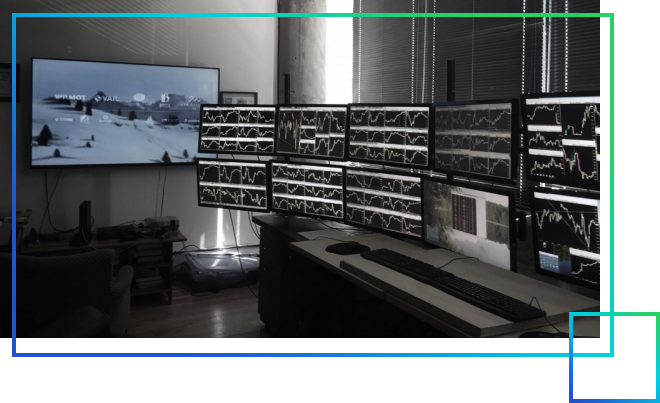

What Makes T3’s Trading Technology Better?

In the dynamic marketplace of today, active traders need access to the best low-latency technology. Since one platform may not be the right fit for every trader, T3 Trading offers a variety of professional-grade trading software platforms designed with active traders in mind. Additionally, we offer a variety of cost-effective execution options including lit market venues, dark pools, market maker routes, floor brokers and customizable smart order routing technology.

T3’s dark pool aggregators and smart order routers allow our traders to have best execution and direct those orders to their preferred destination. T3 has partnered and integrated with various industry leading platforms to fit your unique trading needs and asset classes. T3 is always seeking to offer traders a trading advantage using the technology that best suits them and their strategies.

Our Trading Platforms

The platforms we offer are determined by the asset class being traded. Our staff is fully trained to provide any technical assistance and/or troubleshooting that our traders may need. T3 traders utilize the following platforms for execution:

Equities

Lightspeed Trader | Sterling Trader

Realtick | Wolverine (WEX) | Takion

Options

Lightspeed Trader

Sterling Trader | Wolverine (WEX)

Futures

Rithmic | Exegy | TT

CQG | WebICE | CME Direct

Adaptability

Our resources and technology are designed to fit the various needs of all our traders. This includes day traders, swing traders, and portfolio style traders that may be black box, gray box, and/or discretionary traders.

We only offer the best of the industry’s leading technology and platforms, including hotkeys and shortcuts for trade execution.

Algorithmic Trading Systems

T3 has complete support for discretionary, gray-box, and black-box trading systems. We have an extremely skilled development team and back office staff dedicated to our algorithmic trading systems.

Through strategic relationships, we are able to provide our traders with superior technology providers, such as Instinet. Traders execute their strategies with superb quickness and accuracy while maintaining risk management integrity.

Please reach out to us regarding potentially significant cost savings using our Non-Display data feeds.