Why Trade with T3?

T3 has been committed to creating Elite Solutions for the Active Trading Community for over a decade.

Professional traders receive access to firm capital for superior leverage both intraday and overnight, great locates for short selling (even in hard to borrow stocks), a community of like-minded seasoned professionals to trade alongside and competitive trading cost and payout structures.

Our Trading Offering

We offer Multiple Asset Classes and Automated Trading:

Equities Trading

T3 uses multiple clearing firms including Marex Clearing Services and Velocity Clearing LLC – Catering to Active, Professional and Proprietary Traders – Competitive Fees and Cost Structures

Contact Us to learn about smart order routing through Clearpool Technologies

Options Trading

Equity options trading is available for both Hedging Strategies and Speculation. We Allow Multiple Legs and Spread Trading (with Compliance and Risk Approval).

T3 employs smart order routing through Dash Technologies. Learn More

Futures Trading

T3 offers a variety of services that cater to both experienced traders and beginners through competitive profit splits, transparent cost structures, financial backing, flexible work environment, and education.

Reach Out to Learn More or Contribute to our Futures Trading Team

Algorithmic Trading

T3 offers API Access to multiple platforms through Instinet and co-location in various data centers (Carteret, Great River etc). We have decades of Black Box and Automated Trading Experience.

Ask Us about our Reduced Pricing on Non-Display Market Data

Active Retail

Private Access is a trading account for Professionally-Minded Traders without the years of schooling and licensing. Open an active retail account and get advantages professional traders enjoy.

Learn more

Start a Career as a Professional Proprietary Trader

Flexible Funding & Commission Structures

Traders are required to make a capital contribution to open an account. But every applicant is different.

Get in touch for a friendly consultation.

We'll design a capital contribution and commission structure tailored to your needs.

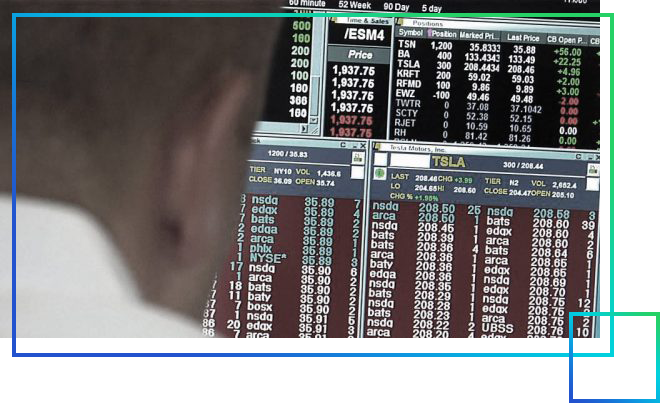

Cutting Edge Infrastructure for Equities, Options, and Futures Traders

T3 traders get direct remote access to exchanges, ECMs, and dark pools with ultra low latency.

You can also take advantage of our advanced algorithmic trading capabilities, including API access to multiple platforms and co-location in major data centers.

Our team has decades of experience in creating customized tech stacks for equities, options, and futures traders, and we’ll work with you to optimize your setup.

Support You Can Count On

Have a question about buying power, trading technology, or your account?

T3 has an experienced bench of support staff including trading support from 4 am – 7 pm, finance, accounting, and technology experts to help you grow your trading book.

Industry Leading Buying Power

No profitable trader should be held back because of a lack of capital. We’ll be there to give you the buying power you need as you move up the ladder.

As you succeed, you can scale up to multiply your returns, (subject to risk management approval).

Extensive Training Available

We offer access to training programs covering technical analysis, order execution, and market operations across multiple asset classes via our affiliate T3 Live*.

T3 Traders get access to multiple Virtual Trading Floors® and resources.

We also sponsor new traders for the SIE and Series 57 Exams.